❜embed is scaling: Production infrastructure for a personalized web3

Announcement

Product

Dec 18, 2025

TLDR:

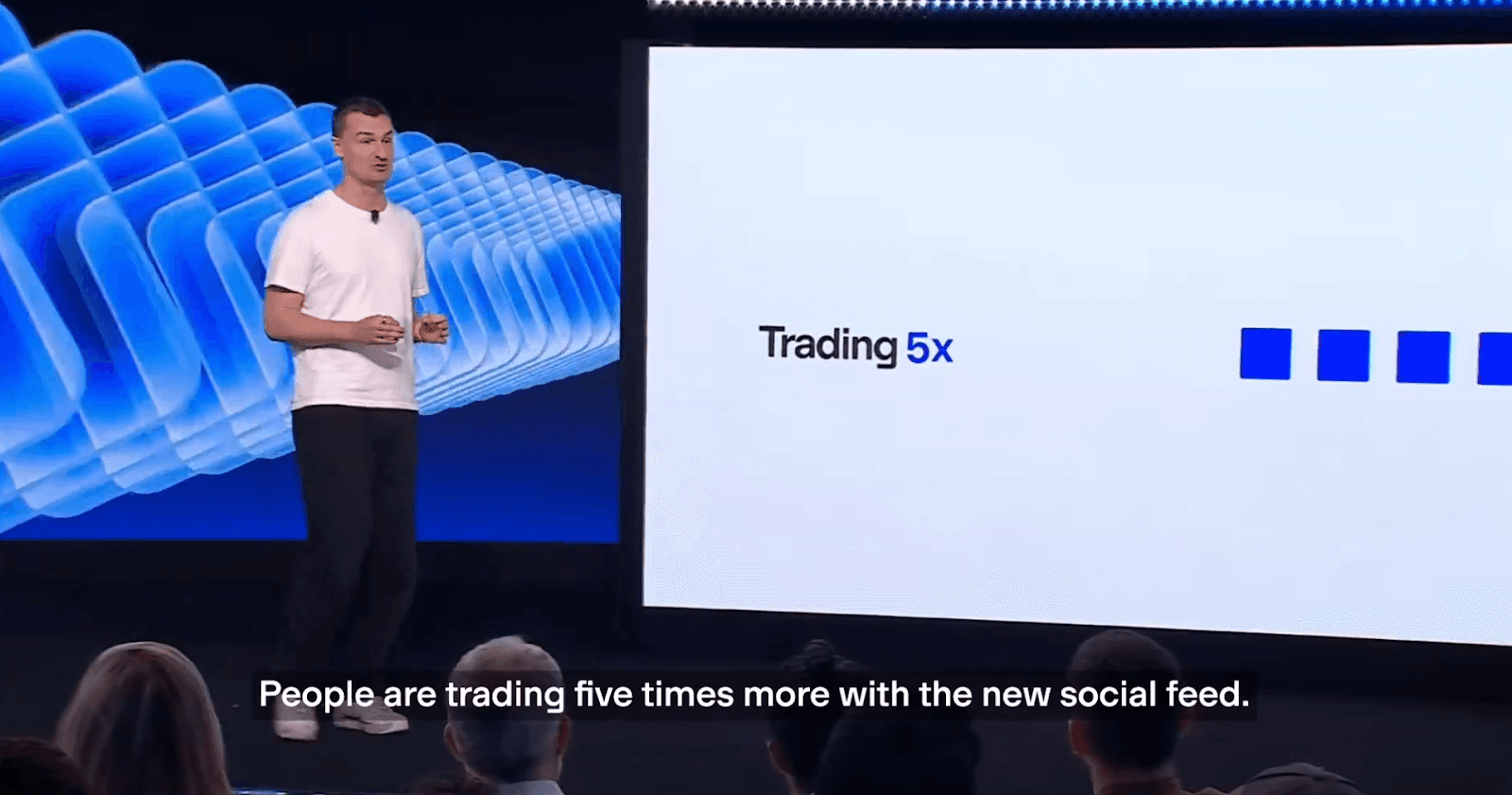

Base app is live: We are powering personalized feeds in the Base app (Jesse Pollak: "5x increase in transactions")

Enterprise scale: We've built enterprise-scale infrastructure in partnership with AWS, handling 100M API calls. AWS featured us on their Web3 blog.

Platform expansion: We've added Zora (100% coverage, beta) and Polymarket (100% coverage, alpha) to our data sources. See our docs.

We’re growing fast: 650+ developers, 2,000+ live algorithms, 65% MoM growth.

Market signal: Base, Phantom, Metamask, Rainbow, Robinhood, Fireplace, Degen, Zora, Zerion, OKX, Binance, Interface, fomo, Clicker, Fireplace, Polymarket, Kalshi are all looking at or building personalized feeds.

What's new: We've shipped 10+ new Feed Builder features (visit our blog) and entirely revamped our documentation.

What's next: We're aiming to help solve retention in web3 in 2026—this is the next frontier.

We’re ready, see you in 2026.

❜embed is scaling: Production infrastructure for a personalized web3

Base is using ❜embed to power their personalized feeds inside the Base app. Jesse said it yesterday—feeds increase the amount of transactions by 5x.

Dozens of engineers and PMs at Base have created feed algorithms through the ❜embed no-code tool and APIs. So have hundreds of other developers building across Farcaster, Zora, and Polymarket.

Here's how we built the infrastructure to make that possible and why 2026 is when we scale it.

The Discovery Problem is Still Pressing

But first let us preface this post noting that we're closing 2025 and CT and X are still the main discovery engines for onchain assets. We believe that's a bug, not a feature.

Every web3 platform faces the same challenge: users can't find what matters to them. Most wallets until very recently have been showing generic token lists. Leading prediction market platforms bury relevant events under hundreds of identical-looking options while discovery for prediction markets has been a hot topic for months.

As a result, the web3 UX experience remains overwhelming.

Thankfully in the past few months, platforms like Base, Phantom, Metamask, or Robinhood have started to understand that personalized social experiences aren't a nice-to-have but critical infrastructure.

At ❜embed, we're building the intelligence network to power the recommendation of onchain assets.

Building For Scale And Enterprise

Last year, we raised $3M in pre-seed funding with a specific thesis: web3 needs an intelligence layer for onchain assets. We didn't start by chasing users. We started by building infrastructure that could handle real scale.

Building on the experience of our team, we partnered with AWS to create enterprise-grade architecture that we've carefully developed. It was about building something that could support platforms like Coinbase from the start—high availability, low latency, privacy-preserving design.

AWS featured our approach in their official Web3 blog.

Expanding Our Onchain Asset Universe

Throughout 2024 and 2025, we proved our recommendation engine could adapt to different types of onchain assets and deliver relevance at scale.

Farcaster integration came first. Social feeds are the hardest personalization problem: high velocity, context-dependent, taste-driven. If we could solve feed personalization for onchain social, we could solve it for anything.

We did. Then we expanded.

Zora coverage came as a logical next step. We now index 100% of Zora tokens, currently in public beta. We believe tokenized content is one of the net new categories of onchain assets that'll grow exponentially over the next few years.

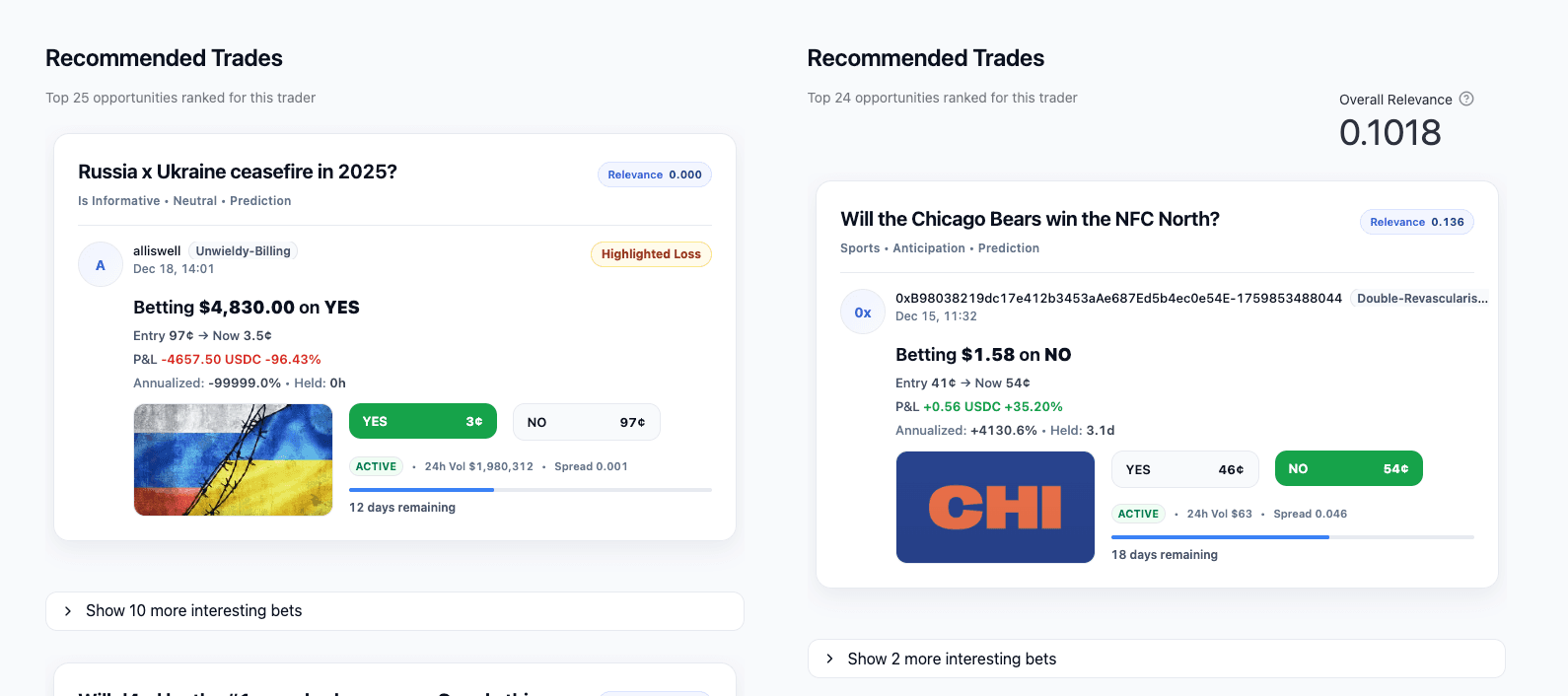

Polymarket integration launched in alpha with 100% market coverage. This is where the discovery problem is most obvious: hundreds of prediction markets, most irrelevant to any individual user. Our engine filters and ranks markets based on users' trading history, attention patterns, and similar user behavior.

Reach out to try our demo (below).

Each integration wasn't just about adding data sources. It was about proving our core thesis: one recommendation engine, adaptable to any onchain asset type, delivering relevance at scale.

Real Adoption, Ready to Scale

Platform expansion is translating into product adoption.

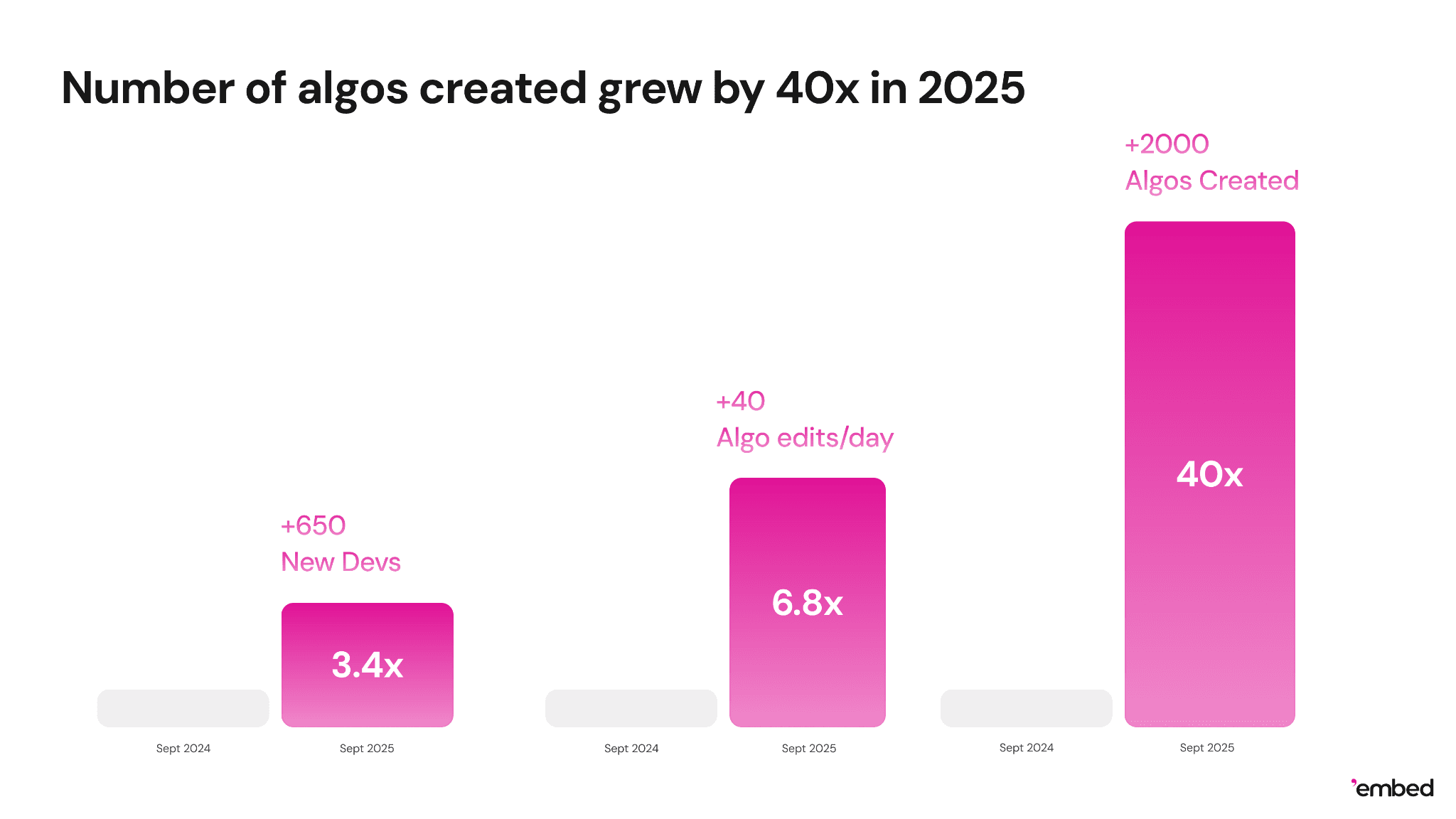

We started 2025 with 50 live recommendation algorithms. Today, there are over 2,000 deployed, as builders realize that personalization is critical infrastructure, not a feature one can build in-house overnight.

Developer growth: Developer activity tells the same story. From under 200 builders at the start of 2025 to 650+ today, creating algorithms on our no-code tool and calling personalized feeds through our APIs.

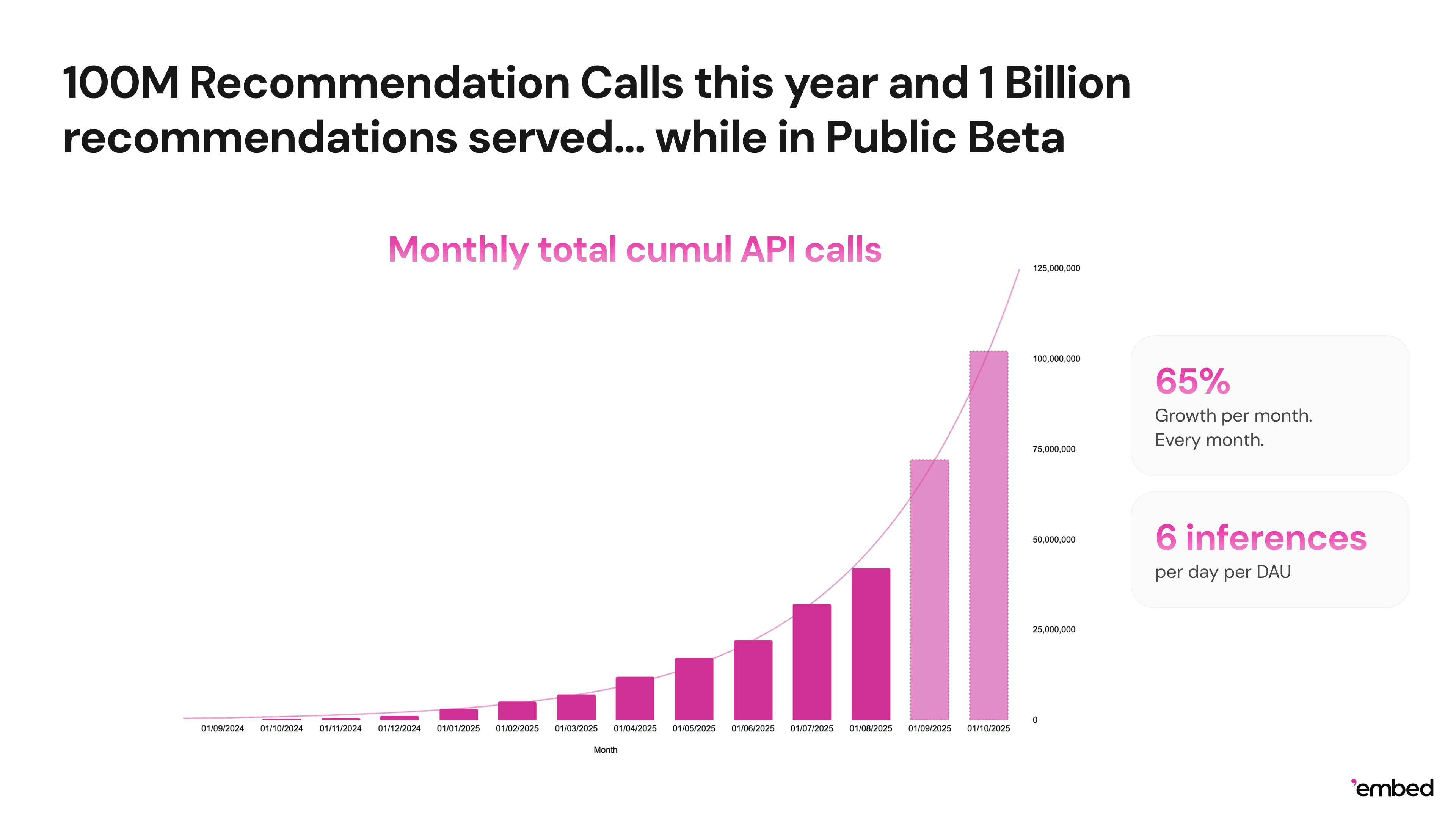

API volume: We're approaching 100 million recommendation API calls—still in public beta. We'll cross that threshold in Q1 2026.

Sustained growth: 65% month-over-month growth rate, consistent across the year. Not spiky. Not incentive-driven. Organic adoption from platforms that need this infrastructure.

These numbers represent something specific: platforms choosing to build personalized experiences with ❜embed rather than building recommendation engines from scratch. And users experiencing those recommendations every single day.

Enterprise Validation: The Coinbase Signal

The strongest proof point isn't a metric but rather a live product with a top project in the space. Base is using ❜embed to personalize the Talk Tab feeds and video experience in an app released to millions of users.

When a platform at Coinbase's scale trusts your infrastructure for their user experience, it validates three things:

Reliability: Your system doesn't go down. It handles traffic spikes. It recovers gracefully from errors.

Performance: Your recommendations load fast enough that users don't notice them. Latency is low. Response times are predictable.

Quality: Your relevance engine actually works. Users engage more. Retention improves. The product gets better.

Jesse Pollak said on the Coinbase System Update event that the social feed was increasing transactions by 5x in the Base app.

Coinbase didn't choose us because we were cheap or convenient. They chose us because we built production-grade infrastructure that solves a real problem at their scale.

That's the standard we're holding ourselves to as we expand.

Ready for 2026

There are a few things we've learned that we'll be taking with us into 2026. Let's unpack them.

Developer experience is everything. Our Feed Builder went through four major iterations based on developer feedback. The goal: make it possible for non-ML engineers to create sophisticated recommendation algorithms. We also revamped our documentation: https://docs.getembed.ai

Scale reveals problems you can't predict. Edge cases that seemed theoretical at 1M API calls became critical bugs at 50M. We rebuilt parts of our infrastructure three times to handle scale we didn't anticipate.

Onchain assets are the net new feature we're doubling down on. We've seen the growth of prediction markets. We believe that new kinds of onchain assets are going to keep emerging—content coins, financial products that all neobanks will eventually integrate. We'll keep building the intelligence layer for onchain assets.

Retention isn't solved. We'll leave that to another piece, but basically, we have a lot of work ahead to make personalization the killer feature that'll double retention for apps leveraging onchain content across industries.

Working with the very best teams matters a lot. We couldn't have made it without our partners, from Neynar to the Base team. The quality of our service has been defined by their own design decisions and feedback.

Why This Matters

Web3 has solved hard technical problems: trustless execution, permissionless composability, verifiable ownership. But we haven't solved basic UX problems.

Users still can't find what matters to them. Discovery is still manual. Relevance is still missing.

That's not a blockchain problem. It's an intelligence problem. And it's solvable with the right infrastructure.

❜embed is that infrastructure.